Student loans play a pivotal role in financing higher education, but they also significantly influence your credit score—a key indicator of financial health. So, it is essential to understand the relationship between higher education loans and financial health, especially for maintaining a strong credit profile.

Your credit score is determined in terms of the FICO score, which is the Fair Isaac Corporation Score. It is a widely recognized credit scoring system that lenders use to evaluate an individual's creditworthiness. FICO score is determined by several factors, among them, payment history and debt levels are the most influential factors. Student loans, as installment debts, affect these components in the following ways:

Payment History (35% of FICO Score):

- Positive Impact: Consistently making on-time payments proves reliability, and it boosts your credit score.

- Negative Impact: Missed or late payments can lead to significant score reductions. For instance, recent reports indicate that borrowers who missed payments after the resumption of student loan obligations experienced substantial credit score declines.

Amounts Owed (30% of FICO Score):

- Debt-to-Income Ratio: High student loan balances can increase your debt-to-income ratio, potentially lowering your credit score and affecting your ability to secure additional credit.

Length of Credit History (15% of FICO Score):

- Establishing Credit: Student loans can help build a credit history, especially for young borrowers, positively influencing this aspect of your score over time.

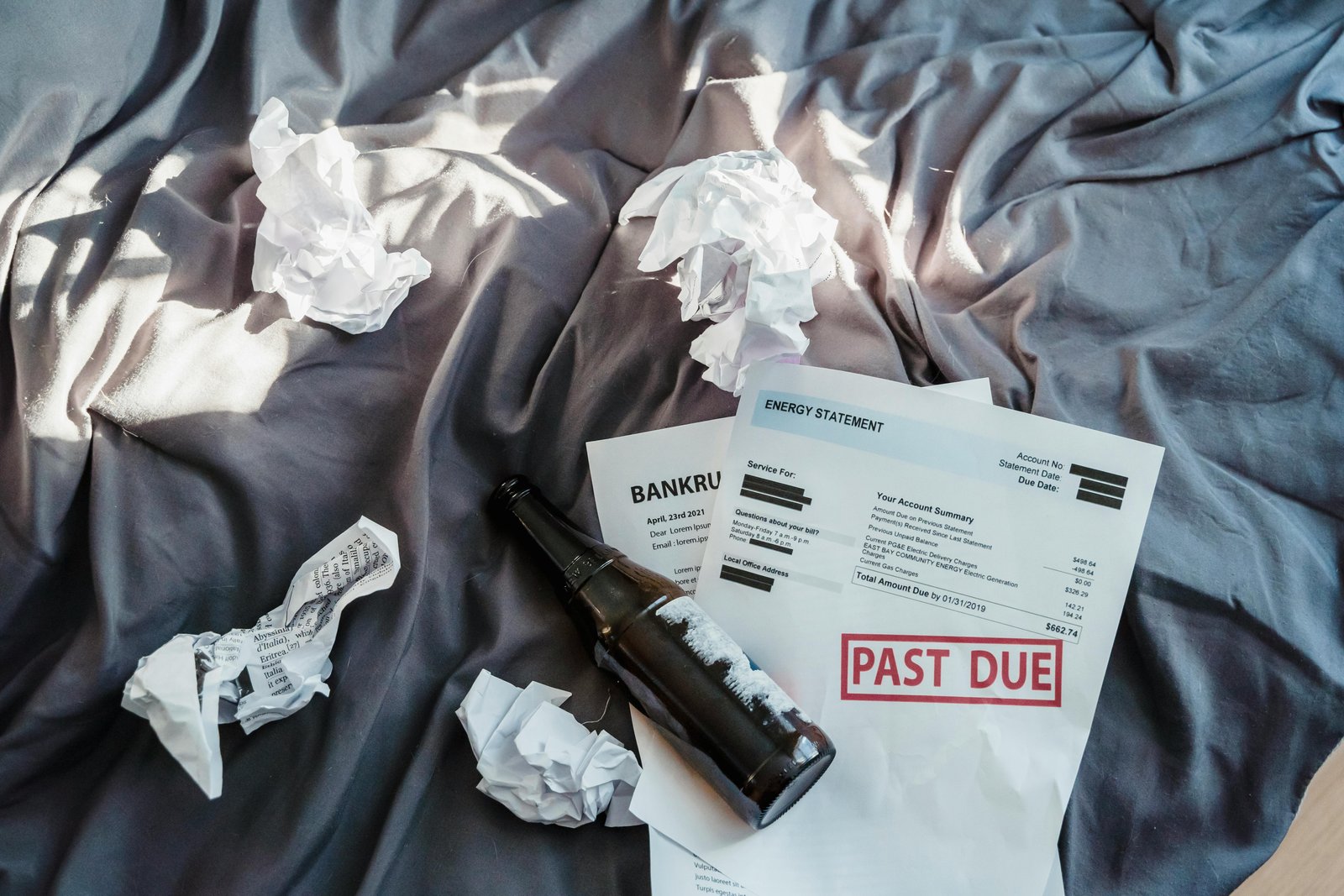

Consequences of Defaulting on Student Loans

Defaulting on student loans—typically after 270 days of non-payment can have severe repercussions.

- Credit Score Damage: Defaults can remain on your credit report for up to seven years, drastically reducing your score and hindering future credit opportunities.

- Collection Actions: The government may garnish wages, seize tax refunds, or take legal action to recover the owed amounts.

Strategies to Mitigate Negative Impacts

To maintain a healthy credit score while managing student loans, you can try any of these or all.

- Enroll in Income-Driven Repayment Plans: These plans adjust your monthly payments based on income, making them more manageable and reducing the risk of missed payments.

- Set Up Automatic Payments: Automating payments ensures timely fulfilment of obligations, positively influencing your payment history.

- Monitor Your Credit Report: Regularly reviewing your credit report helps identify and address discrepancies or issues promptly.

Recent Developments

As of October 2024, the pandemic-era relief on federal student loans ended, and the 90-day period for borrowers to resume payments has expired. This resumption has led to significant credit score reductions for those who have fallen behind. Approximately 43% of federal student loan borrowers have not resumed payments, putting over nine million people at risk of severe credit score declines.

Managing student loans responsibly is crucial for maintaining a favorable credit score. A lot depends on how you manage your student loan, especially the credit score that depends on it. So, you need to understand the impact of your loans and implement proactive repayment strategies. All these will help you to safeguard your financial future while reaping the benefits of your educational investments.